*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

How to Calculate DSCR Ratio for Rental Property: A Step-by-Step Guide for Investors

Understanding the financial health of a rental property is crucial for investors, and one key metric stands out: the Debt Service Coverage Ratio (DSCR). This powerful tool helps determine whether a property's income can cover its operating expenses and debt obligations. For anyone looking to secure financing or evaluate their investment's performance, knowing how to calculate the DSCR is a game-changer.

The DSCR isn't just a number; it's a reflection of a property's financial stability. Lenders often rely on it to assess risk, while savvy investors use it to make informed decisions. By breaking down the formula and understanding its components, investors can gain clarity on their property's profitability and long-term viability. Whether you're new to real estate or a seasoned pro, mastering this calculation can give you a competitive edge in the market.

What Is DSCR And Why It Matters For Rental Properties

The Debt Service Coverage Ratio (DSCR) measures a property's ability to generate enough income to cover debt payments. It compares a property's Net Operating Income (NOI) to its total debt service. A higher DSCR indicates that a property generates sufficient income to meet its financial obligations, reducing risk for lenders.

For rental properties, DSCR is crucial because lenders prioritize properties with strong financial stability. A DSCR of 1.25, for example, means a property earns 25% more than its debt payments, demonstrating profitability. Properties with lower DSCR values may struggle to secure financing, as they represent higher default risks.

Investors also rely on the DSCR to assess long-term viability. Properties with consistent positive DSCR values are better suited for growth and portfolio diversification. By understanding and using DSCR, investors can make confident and data-backed investment choices.

Steps To Calculate DSCR Ratio For Rental Property

Calculating the Debt Service Coverage Ratio (DSCR) for rental property requires a systematic approach to ensure accuracy. Focus on understanding the formula, gathering relevant financial data, and performing precise calculations to derive actionable insights.

Understanding The Formula

The DSCR formula compares a property's Net Operating Income (NOI) to its total debt service. The standard calculation is:

DSCR = Net Operating Income (NOI) ÷ Total Debt Service

NOI represents the property's income after operating expenses, excluding debt payments and capital expenditures. Total debt service includes all annual principal and interest payments on loans.

Gathering Necessary Financial Data

- Calculate Gross Rental Income – Include monthly rents and additional income sources such as parking or storage fees.

- Determine Operating Expenses – Subtract recurring costs like property taxes, insurance, maintenance, and property management fees.

- Identify Total Debt Service – Sum all annual principal and interest obligations related to the property’s financing.

Ensure all figures are accurate and based on current financial records for precise calculations.

Performing The Calculation

Divide the calculated NOI by the total debt service. For example, if a rental property generates $60,000 NOI annually with $48,000 in total debt service, the DSCR equals 1.25. This indicates the income exceeds debt obligations by 25%. Values below 1 imply insufficient income to cover debts, while higher values suggest greater financial stability.

Factors That Influence DSCR For Rental Property

Several factors play a critical role in determining the DSCR for rental properties. These factors directly impact the relationship between income and debt obligations, shaping the property's financial stability.

Rental Income

Rental income forms the foundation of DSCR calculations. Higher rental income increases the Net Operating Income (NOI), improving the DSCR value. This income includes tenant rents and additional revenue streams such as parking fees or storage rentals. Consistent occupancy rates and market-competitive rents are essential for maximizing income.

Operating Expenses

Operating expenses affect the NOI by reducing the income used to cover debt service. These expenses include property management fees, maintenance costs, insurance premiums, and property taxes. Low, well-managed expenses lead to a larger NOI, enhancing the DSCR. Poorly controlled or rising expenses lower the DSCR, increasing financial risk.

Loan Terms

Loan terms determine the debt service amount, influencing DSCR outcomes. Interest rates, loan duration, and repayment schedules affect total monthly debt obligations. Loans with high-interest rates or short repayment periods raise debt service costs, reducing DSCR values. Favorable terms, such as longer loan periods and competitive rates, support healthier DSCRs.

Ideal DSCR Ratio And What It Means

A Debt Service Coverage Ratio (DSCR) above 1.0 indicates that a rental property generates enough income to cover its debt obligations. For most purposes, a DSCR of 1.25 is considered optimal, signifying a 25% surplus income after covering debt payments.

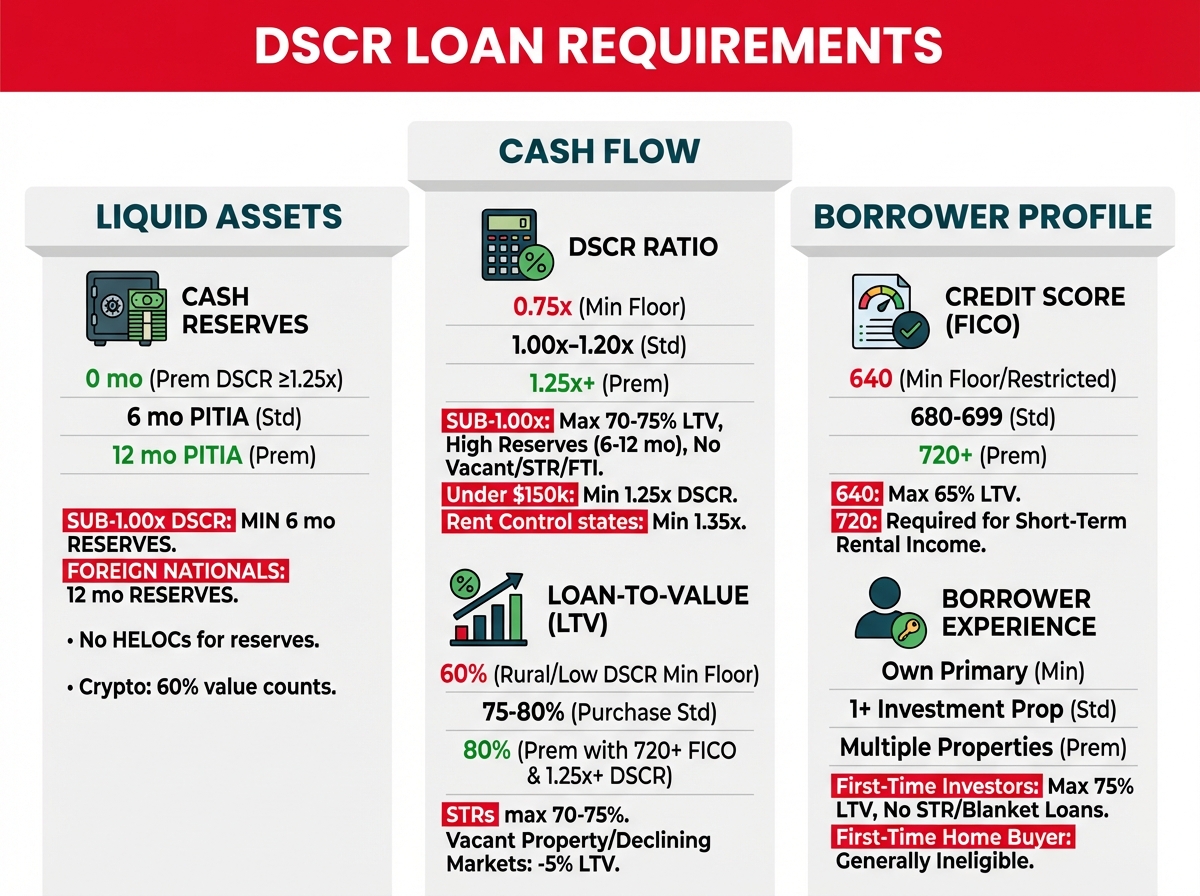

Minimum DSCR Requirement By Lenders

Lenders generally require a minimum DSCR of 1.20 for rental property loans to reduce default risk. Properties with DSCR values under 1.0, such as 0.85, signal insufficient income to cover debt, making financing difficult. For rental-specific properties, commercial lenders often prefer DSCR thresholds between 1.20 and 1.50. This range accounts for external factors like market volatility or unexpected expenses that could impact income.

Borrowers with properties exceeding the minimum DSCR requirement may qualify for favorable loan terms. For instance, strong DSCR values often lead to lower interest rates, higher loan amounts, or more flexible repayment schedules. A DSCR below the lender's benchmark typically necessitates higher down payments or escalated interest rates to offset financial risks.

DSCR Implications For Investors

For investors, DSCR values directly reflect property sustainability. Properties with DSCR ratios consistently above 1.25 indicate long-term profitability and reliable income generation. For example, a DSCR of 1.35 suggests the property generates 35% more income than required for debt coverage, aligning well with growth-oriented investment strategies.

Lower DSCR values, especially under 1.0, suggest cash flow challenges. Investors targeting such properties may need to implement cost-reduction strategies or increase rental revenue to achieve financial stability. Conversely, properties with DSCR values in the optimal range offer opportunities for portfolio diversification and reduced financial risks.

Additionally, DSCR influences competitive standing in the market. By focusing on properties with high DSCR values, investors effectively mitigate risks while securing a steady return on investment.

Tips To Improve DSCR For Your Rental Property

Enhancing the DSCR for a rental property strengthens its financial viability and increases its attractiveness to lenders and investors. Strategic adjustments to income, expenses, and financing can lead to significant improvements.

Boosting Rental Income

Increasing gross rental income directly impacts the Net Operating Income (NOI), improving the DSCR. Investors can raise rental income by conducting market research to ensure competitive pricing and enhancing property features to justify higher rents. Maintaining high occupancy rates through effective tenant retention strategies, such as responsive maintenance and lease renewal incentives, also supports consistent cash flow.

Reducing Operating Costs

Lower operating expenses increase NOI, positively affecting the DSCR. Property owners can achieve savings by negotiating better rates for property management services, reducing energy costs with efficient appliances, and performing preventative maintenance to avoid costly repairs. Reviewing recurring expenses and identifying areas for cost-effective adjustments helps further optimize NOI.

Restructuring Financing

Revising loan terms reduces total debt service, significantly enhancing the DSCR. Borrowers may explore refinancing options to secure lower interest rates or extend loan repayment schedules. Switching to interest-only periods, when available, can temporarily lower monthly obligations, providing relief for cash flow while increasing DSCR values.

Tools And Resources To Simplify DSCR Calculations

Various tools and resources streamline DSCR calculations, ensuring accuracy and saving time for investors and property managers.

1. Financial Software

Specialized platforms like QuickBooks and Stessa assist in tracking rental income, organizing expenses, and calculating metrics like DSCR automatically. These tools integrate financial data, reducing manual errors.

2. Online DSCR Calculators

Free or subscription-based DSCR calculators, such as those offered by property management websites, enable precise calculations by inputting Net Operating Income and total debt service data. These calculators simplify complex computations.

3. Spreadsheets

Excel and Google Sheets, with built-in formulas, allow users to customize DSCR calculations based on specific variables. Creating templates ensures consistent application across various properties.

4. Accounting Professionals

Certified accountants or financial advisors provide expert insights, especially for complex portfolios or when calculating DSCR for multi-unit properties. They leverage professional expertise to enhance accuracy.

5. Real Estate Analysis Tools

Software like Zillow’s Rental Manager or Buildium consolidates property performance data while offering built-in DSCR calculation functionalities. These platforms focus on making investment evaluations efficient.

Each resource adjusts to the user's expertise level and can be used individually or combined for a more comprehensive financial analysis.

Conclusion

Mastering the DSCR calculation is a vital step for investors aiming to make informed decisions and secure profitable rental property investments. A strong DSCR not only reflects financial stability but also enhances opportunities for financing and long-term growth.

By leveraging the right tools and strategies, investors can optimize their DSCR, reduce risks, and position themselves for sustained success in the competitive real estate market. Prioritizing properties with high DSCR values ensures a solid foundation for building a thriving investment portfolio.

Frequently Asked Questions

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio (DSCR) is a metric used to assess a rental property's ability to generate enough income to cover its debt obligations. It compares the Net Operating Income (NOI) to total debt service payments. A DSCR above 1.0 shows the property earns enough to meet its debt payments, while 1.25 is often considered an ideal value by lenders and investors.

Why is DSCR important for rental property investors?

DSCR is crucial because it measures a property's financial stability, helping investors and lenders determine if the income comfortably covers expenses and debt payments. It aids investors in selecting profitable properties, reduces financial risks, and improves decision-making for long-term success.

What is considered a good DSCR for rental properties?

A DSCR of 1.25 or higher is typically seen as ideal. This means the property earns 25% more than its debt payments, providing a financial cushion. Lenders often require a minimum DSCR of 1.20 to approve financing, as lower ratios indicate higher default risk.

How is DSCR calculated for rental properties?

To calculate DSCR, divide the Net Operating Income (NOI) by the total debt service. For example, if a property's NOI is $50,000 and annual debt payments are $40,000, the DSCR would be 1.25. This shows the property earns 25% more than its debt obligations.

What factors influence DSCR for rental properties?

DSCR is impacted by rental income, operating expenses, and loan terms. Higher rent and consistent occupancy improve DSCR, while high expenses and unfavorable loan terms (e.g., high interest rates) can lower it. Effective cost management and favorable financing support healthier DSCR values.

How can I improve the DSCR of my rental property?

To improve DSCR, consider increasing rental income by researching market trends and retaining quality tenants. Reduce operating expenses by negotiating service rates or using energy-efficient solutions. Refinancing loans to secure lower interest rates or longer repayment terms can also enhance DSCR.

Why do lenders care about DSCR?

Lenders view DSCR as a measure of risk. A higher DSCR indicates the property generates enough income to cover debt payments, reducing the likelihood of default. Lenders are more likely to approve loans for properties with strong DSCR values, typically above 1.20.

Are lower DSCR properties a bad investment?

Not necessarily. While a low DSCR signals higher risk and cash flow challenges, such properties may have potential for improvement. Investors can focus on increasing income or reducing costs to enhance DSCR. However, securing financing may be difficult with a low DSCR.

What tools can help me calculate DSCR accurately?

You can use financial software like QuickBooks and Stessa, online DSCR calculators, customizable spreadsheets, or consult accounting professionals for precise calculations. Real estate analysis tools are also helpful for consolidating property performance data and simplifying DSCR evaluation.

How does DSCR impact investment decisions?

DSCR helps investors identify financially stable properties, assess profitability, and reduce risk. Properties with consistently high DSCR values ensure better cash flow, aiding portfolio growth and diversification. Investors can make informed, data-backed decisions using DSCR as a key metric.

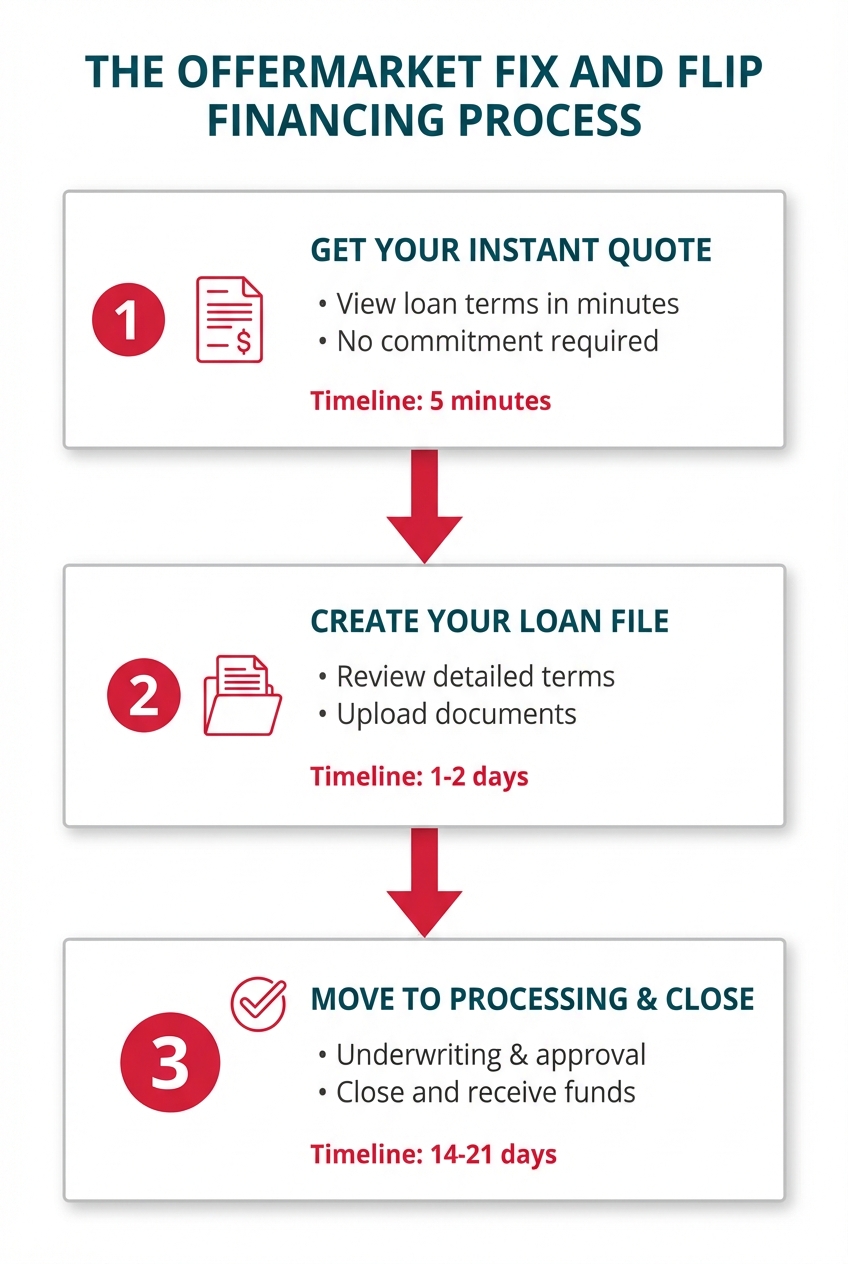

DSCR Loan Quote

Our mission is to help you build wealth through real estate. Let's grow and optimize your rental property portfolio!

- Get your instant DSCR loan quote today!

- Save big on premiums with our landlord insurance rate shopping service!

- Interested in exclusive investment opportunities? Browse off market properties now!

- Join our Facebook community to stay up-to-date with the latest platform updates and market insights.

- Subscribe to our Youtube channel for our monthly DSCR loan update.