*Quote takes 1 minute, no credit pull

Insurance*1 quote from 40+ carriers

Listings*New listings daily

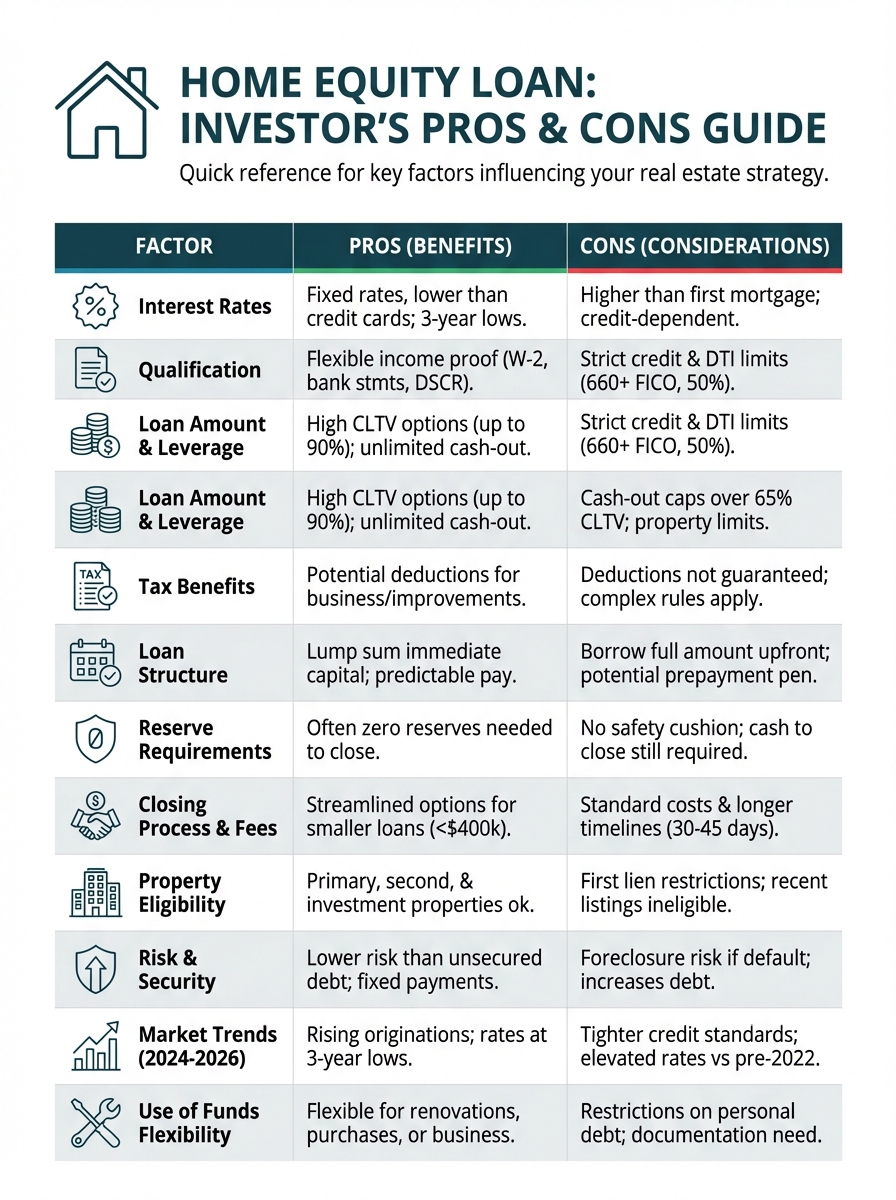

Private Home Equity Loans: Benefits and Risks for Real Estate Investors

Last Updated: March 4, 2025

Private home equity loans can be a game-changer for real estate investors like you. Whether you’re looking to finance a new rental property or fund a fix-and-flip project, tapping into your home’s equity offers a flexible way to access the cash you need. With rising property values, many homeowners find themselves sitting on a goldmine of untapped potential that can help grow their investment portfolio.

In this article, you’ll learn how private home equity loans work, the benefits they offer, and key factors to consider before diving in. By understanding these loans, you can make informed decisions that will enhance your real estate investing strategy. Get ready to discover how this financing option can support your goals and set you on a path to success in your investments.

Overview of Private Home Equity Loans

Private home equity loans allow homeowners to access cash by borrowing against their property’s value. This type of loan is secured by your home, meaning your property serves as collateral. Many property owners can use these loans for various purposes, including funding new rental properties or covering renovation costs for fix-and-flip projects.

These loans often offer fixed interest rates, making repayment predictable. You can typically borrow up to 80% of your home’s equity. Equity is the difference between your home’s current value and the amount you owe on your mortgage. For example, if your home is valued at $300,000 and your mortgage balance is $200,000, your equity amounts to $100,000.

Benefits of Private Home Equity Loans

- Access to Cash: Access immediate funds for investments or major expenses.

- Fixed Rates: Enjoy stable interest rates that don’t change over time.

- Lower Rates: Generally, private home equity loans feature lower rates compared to personal loans or credit cards.

- Tax Deductions: In some cases, interest paid may be tax-deductible.

- Flexible Use: Use the funds for various needs, from home improvements to debt consolidation.

Important Considerations

- Risk of Foreclosure: Borrowing against your home puts it at risk if you fail to repay the loan.

- Fees and Costs: Be aware of closing costs and other fees that can add to your overall expenses.

- Credit Score Impact: Lenders evaluate your credit score and history during the application process. A higher score typically results in better terms.

- Market Variability: Changes in the real estate market can affect your home’s value and consequently your equity.

- Personal Financial Health: Assess your overall financial situation to determine if this loan aligns with your goals.

Understanding how private home equity loans work can help you make informed decisions. These loans offer financial options for property investments and home improvements, allowing you to maximize your property’s potential.

Benefits of Private Home Equity Loans

Private home equity loans offer multiple advantages for homeowners looking to tap into their property's value. These loans provide quick access to cash and can support a variety of financial goals.

Accessibility and Qualification

Private home equity loans often feature less strict requirements compared to traditional lenders. Many homeowners qualify with a good credit score, stable income, and a sufficient amount of equity in their home, typically around 20%. Lenders base their decision on the home's current market value and your ability to repay the loan. You can access funds more quickly, as the application process often involves fewer steps and less paperwork than conventional loans. This accessibility makes private home equity loans attractive for those looking to finance immediate needs or investment opportunities.

Flexible Usage of Funds

Private home equity loans allow you to use the funds for various purposes. Whether you aim to finance home improvements, consolidate debt, or invest in real estate, these loans provide flexibility. Many borrowers fund major renovations that increase property value, leading to potential higher returns. Others use funds to reduce high-interest debt by paying off credit cards, promoting better financial health. The freedom in how to use the loan can contribute significantly to improved financial management and investment strategies.

Risks and Considerations

Private home equity loans come with specific risks and considerations that you must evaluate before proceeding.

Interest Rates and Fees

Interest rates on private home equity loans can vary significantly. These loans typically offer fixed rates, which may be lower compared to personal loans or credit cards. However, some lenders may charge higher rates based on your credit profile. Fees can also add up. Look out for origination fees, appraisal fees, and closing costs. These can impact the overall cost of borrowing. It’s crucial to read the loan agreement thoroughly to understand all the expenses associated with the loan.

Market Fluctuations

Market fluctuations can significantly affect your home’s value. If property values decline, you may owe more on your loan than your home is worth, known as being underwater. This situation increases the risk of foreclosure if you default. It's essential to monitor local real estate trends and understand how changes may impact your investment. Keeping updated on the market will help you make informed decisions about your home equity loan and potential risks involved.

Comparing Private Home Equity Loans to Other Financing Options

Private home equity loans provide specific advantages compared to other financing methods. Understanding these differences allows you to choose the right option for your financial needs.

Personal Loans

Personal loans offer a set amount of money that you repay in fixed monthly payments over a specified term. Interest rates tend to vary based on your credit history and financial situation, often resulting in higher rates than private home equity loans.

- Personal loans usually lack collateral, meaning you won’t risk losing any property if you fail to repay.

- Loan amounts often range from $1,000 to $100,000, while private home equity loans may allow borrowing up to 80% of your home’s equity.

- Personal loans often require less documentation and a quicker application process than traditional loans but may take longer than private home equity loans.

- Tax benefits aren't available for personal loan interest, while interest on private home equity loans can qualify for tax deductions.

Assessing these options helps you understand which suits your financial strategy best.

Credit Cards

Credit cards offer a revolving line of credit that allows you to borrow money as needed, up to a certain limit. This option provides flexibility, but it often comes with pitfalls.

- Credit cards tend to have higher interest rates than private home equity loans, making carrying a balance more expensive.

- You can use credit card funds for various purchases, but you often face the risk of accruing debt quickly without a fixed payment plan.

- Credit card companies usually require minimum payments each month, which can lead to extended repayment periods and increased interest costs.

- Paying off credit card debt may impact your credit score due to high utilization rates, whereas private home equity loans can improve your credit mix over time.

Evaluating these options enables you to make informed decisions about your finances.

Comparison Table: Financing Options

Below is a table that compares private home equity loans with other common financing options:

| Loan Type | Interest Rate Type | Max Borrowing Potential | Risk Level | Tax Deduction |

|---|---|---|---|---|

| Private Home Equity Loan | Fixed | Up to 80% of home equity | Moderate (secured by home) | Possible deduction on interest |

| Personal Loan | Fixed or variable | Typically $1,000 to $100,000 | Low (unsecured) | No |

| Credit Card | Variable | Based on credit limit | High (revolving debt) | No |

This table provides a clear side-by-side comparison to help you decide which financing method may be best for your situation.

Strategies for Managing Loan Repayment

Effective management of loan repayment is critical to avoid financial difficulties. Here are some practical tips to keep in mind:

- Create a Budget:

Outline your monthly income and expenses. Allocate a specific portion for loan repayment to avoid missed payments. - Set Up Automatic Payments:

Automating your payments can help you avoid late fees and ensure that your repayment schedule is followed diligently. - Monitor Interest Rates:

Even with fixed-rate loans, keeping an eye on market conditions may help you decide if refinancing becomes beneficial in the future. - Plan for Extra Payments:

If possible, consider paying more than the minimum required. Extra payments can reduce the overall interest cost and shorten the repayment period. - Consult Financial Experts:

When in doubt, seek advice from financial counselors or loan officers. They can help you design a repayment plan that suits your current financial situation.

These strategies are designed to help you stay on track with your loan repayments and avoid the risk of default.

How to Prepare for Market Fluctuations

Market conditions can change unexpectedly, and being prepared is essential for maintaining financial stability. Consider the following approaches:

- Regularly Review Your Home’s Value:

Keep informed about the trends in your local real estate market. Regular evaluations can help you gauge whether your home’s value is increasing or decreasing. - Build an Emergency Fund:

Maintain a reserve of cash that can cover several months of mortgage or loan repayments in case of market downturns. - Keep a Long-Term Perspective:

Real estate markets often fluctuate. Focus on long-term trends rather than short-term changes, which can help you make more measured decisions. - Reassess Your Loan Terms:

If market conditions change, consider discussing your situation with your lender. In some cases, it might be possible to adjust your repayment terms to better suit your financial needs.

By preparing for market fluctuations, you can reduce the stress associated with sudden changes and keep your investments on a steady course.

Practical Advice for Using Loan Funds Wisely

Using funds from a private home equity loan wisely can help you achieve your financial goals. Here are some simple guidelines:

- Prioritize High-Impact Projects:

Use the funds for improvements or investments that have a strong potential to increase your property’s value or generate income. - Avoid Unnecessary Expenditures:

Stick to projects that align with your long-term financial plans. Avoid spending on items that do not contribute to growth or stability. - Review All Expenses:

Before committing, prepare a detailed budget that includes all potential costs. This will help you avoid unexpected expenses later on. - Keep Detailed Records:

Maintain accurate records of how the funds are used. This documentation can be useful for future planning and, in some cases, for tax purposes. - Consult Professionals:

If you are unsure about where to invest the funds, talk to real estate professionals or financial advisors who can offer guidance based on current market conditions.

Following these tips can help ensure that the money you borrow is used in a way that supports your overall financial strategy.

Key Takeaways

- Definition and Purpose: Private home equity loans allow homeowners to borrow against their property's equity, providing access to cash for various purposes, such as property investments and renovations.

- Benefits: Key advantages include immediate cash access, fixed interest rates, generally lower rates compared to personal loans, potential tax deductions, and flexible usage of funds.

- Risks: Borrowing against your home carries risks, such as foreclosure if you default on repayments, and market fluctuations which can affect your home’s value and equity.

- Accessibility: These loans often come with less stringent qualification requirements compared to traditional lenders, enabling quicker access to funding for those who meet basic criteria.

- Comparison with Other Options: Private home equity loans typically offer better rates and terms than personal loans and credit cards, making them a more cost-effective financing option for home projects or investments.

- Informed Decision-Making: Understanding the mechanics, benefits, and risks associated with private home equity loans is crucial for making sound financial decisions that align with your investment goals.

Conclusion

Private home equity loans can be a powerful tool for your investment strategy. By leveraging the equity in your home, you gain access to cash that can propel your real estate ventures forward. With fixed interest rates and flexible use of funds, these loans provide a viable alternative to traditional financing options.

However, it’s essential to weigh the risks against the benefits. Understanding your financial situation and monitoring market conditions will help you make informed decisions. As you explore this financing avenue, remember that careful planning and assessment can lead to successful investments and improved financial health.

Frequently Asked Questions

What are private home equity loans?

Private home equity loans allow homeowners to borrow against the equity in their homes. By using their property as collateral, homeowners can access cash for investment or immediate financial needs, typically up to 80% of their home’s equity at fixed interest rates.

What are the benefits of private home equity loans for real estate investors?

These loans provide immediate cash access, stable interest rates, lower rates than credit cards, potential tax deductions on interest, and flexible funding uses. They enable investors to finance new rental properties or fund fix-and-flip projects efficiently.

What risks are associated with private home equity loans?

The primary risk is foreclosure if the loan is not repaid. Other considerations include additional fees, fluctuating home values, and how credit scores impact loan terms. Monitoring local real estate trends is crucial.

How do private home equity loans compare to personal loans and credit cards?

Private home equity loans generally offer lower interest rates and fixed payments, while personal loans may have higher rates without collateral risk. Credit cards provide revolving credit but can lead to unmanageable debt due to higher interest and lack of a fixed plan.

Who qualifies for private home equity loans?

Many homeowners with a good credit score and sufficient equity qualify for these loans, as they typically have less strict requirements compared to traditional lenders. The application process is also quicker and involves less paperwork.

How much equity can I borrow from a private home equity loan?

Homeowners can generally borrow up to 80% of their home’s equity through private home equity loans. This amount can vary based on the lender's terms and the homeowner's credit profile.

Can I use the funds from a private home equity loan for any purpose?

Yes, funds from a private home equity loan can be used for a variety of purposes, including home improvements, debt consolidation, or real estate investments, providing significant flexibility in financial management.

How can I ensure I make a wise decision about borrowing?

To make a wise decision, assess your personal financial health, understand the implications of market changes on home values, compare loan options, and ensure you can comfortably repay the borrowed amount without risking foreclosure.

DSCR Loan Quote

Our mission is to help you build wealth through real estate. Let's grow and optimize your rental property portfolio!

- Get your instant DSCR loan quote today!

- Save big on premiums with our landlord insurance rate shopping service!

- Interested in exclusive investment opportunities? Browse off market properties now!

- Join our Facebook community to stay up-to-date with the latest platform updates and market insights.

- Subscribe to our Youtube channel for our monthly DSCR loan update.